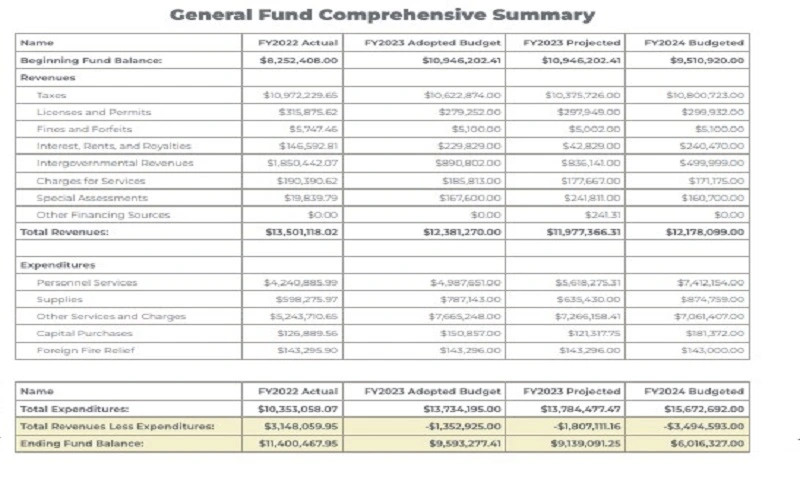

The operating budget is the plan for what a company expects to spend, usually over one year. The costs of doing business, like salaries, rent/utilities suppliers, etc. businesses can review the money they had spent in comparison to budgeted spending business did or planning companies have gone upon and so on. It is the best definition of what a budget should be. A plan for businesses to model their operations and effectively manage costs.

What are the parts of the operating budget?

The operating budget is the more relevant and valuable. Generally, the budget should have a general summary and other supporting sub-budgets. Some parts of these budgets are:

Revenue:

Revenue is usually money that a company receives from its income streams like sales and services. In budgets, many companies break down their revenue into drivers and components.

Revenue drivers include:

- Volume (customers, products etc)

- Price (average price, segment price, etc)

Fixed costs:

Fixed costs are operating expenses that do not change as the volume of business activity increases or decreases Fixed costs are usually regular expenditures that do not depend directly on output, such as rent, interest payments, insurance, and property taxes.

Non-cash expenses:

These expenses have no cash flow implications but will hit the year-end financial reporting performance. These expenses include depreciation, deferred income taxes, stock-based compensation, and amortization.

Non-operating expenses:

Non-operating expenses are the EBIT or cash flow from operations after a subtraction of lower earnings. Some costs that might be included in the budget:

- Interest

- Taxes

Why operating budget is important in business?

Budgets are central to effective business planning because they enable organizations to analyze their financial performance to make realistic future budgets. They can then use these forecasts to plan their activities, such as internal restructuring or expansion. These budgets are also guidelines for a company’s operations that organizational leaders can use to ensure they achieve appropriate goals supporting organizational objectives.

Financial Planning: An operating budget helps businesses plan their finances in a way that allows them enough money to cover any costs, but also invest in growth opportunities.

Expense Management: When companies set budgets, they can be saved from overspending and better control costs.

Performance Monitoring: Comparing actual performance to the budget helps identify areas where the business is performing well and where improvements are needed.

Decision-making: A well-prepared budget provides a basis for making informed decisions about resource allocation and strategic initiatives.

How to create an operating budget?

At this point, you should have information on your actual income and expenses. As your company grows, you will need a budget to maintain it. That requires some industry analysis and some revenue forecasts. Be a rigid person. It is better to overvalue earnings to avoid losses and protect your operating income. Among them:

- Changing trends in a sector or industry

- The actions of competitors

- The company always has to introduce new products

- Changes in the economy

The chief financial officer (CFO) and other executives should be in the best position to calculate forecasted costs that will affect the company, such as rent and taxes. As with revenue estimates, considering historical data and market fluctuation can help arrive at an accurate cost estimate.

How do you find the profit margin per unit?

Finally, you subtract cost per unit from revenue per unit. As a result, you get a number representing one profit unit. The profit remaining after Total Variable cost is taken from revenue also called contribution margin; this shows the portion of sales that helps contribute to fixed costs and profits. You can use the following formula:

(Total Revenue – Total Costs / Total Revenue = Profit Margin)

What are the advantages and disadvantages of operating budget?

Some Advantages of operating budget:

The various advantages that the business gets from the preparation of a budget are:

- Neither the business owner nor the analyst need to go into detail as actual budgets can be compared and assessed to produce results.

- Tracking and managing expenses helps avoid unnecessary waste and expense.

- Increases and improves team performance by providing debt and revenue timing and fixed budgets.

- Operating budget preparation also helps to make informed decisions about any new heavy investment opportunities, capital expenditure, new product development, or expansion.

Some Disadvantages of operating budgets:

- It is based on predication or expectations that cannot be properly judged because there are thousands of other factors in the environment in which an organization operates, such as the regulatory framework, etc. For example, we are in the manufacturing industry and we produce plastics say bags. Then all our preparations and money will be wasted in this matter.

- There is a time commitment related to that budgets are made in the short term. Monetary policy may become unnecessary if there are sudden changes in business conditions.

- Limiting resources for growth, expansion, or innovation can pressure employees, hindering organizational growth.

Conclusion:

An operating budget is essential to successfully controlling a company’s finances. It gives a thorough picture of what your revenue and expenses are going to be over a time frame which should keep you on track of meeting financial goals, staying smooth operationally, as well as giving actionable insights. Regular review and modification of the operating budget allow businesses to alter accordingly as circumstances change so that their business remains solid for years to come.

FAQs:

Q1. Do property taxes exactly match public school budgets?

Ans: Local school funding comes from cities, counties, or school districts themselves. Some of the local funding for schools comes from property taxes. Additional funding from parents through parent-teacher associations and other groups.

Q2. Is tax expense included in operating income?

Ans: Operating income is what remains after a company deducts gross sales (COGS) and other operating expenses from its sales revenue but does not take into account taxes, interest, or finance costs.

Q3. Are operating expenses direct or indirect?

Ans: Operating costs are direct costs required to produce a product or service and are difficult to avoid.

Q4. Why budgeting is important to a business PDF?

Ans: Budgeting planning is essential for business growth and financial stability because it provides a structured framework for planning, resource allocation, decision-making, and risk management Enables businesses to make informed choices, adapt to changing circumstances, and achieve long-term success.

Q5. How is an operating budget developed?

Ans: Operating budget development is a collaborative effort between managers and managers. First, the income for the coming year must be calculated. This includes looking at the company’s historical performance and then assessing market changes that could positively or negatively affect next year’s sales.